Wednesday, October 7th we were lucky enough to have Brian Levitt, Global Market Strategist at Invesco, speak to our clients via Zoom call. His presentation, ‘10 Truths No Matter Who Wins the Election’, was very informative and we encourage you to listen to it if you have the chance. Click the image below to watch the full presentation. The passcode is Lebenthal2020! The slides can also be seen here.

Hartford Funds Webinar Summary

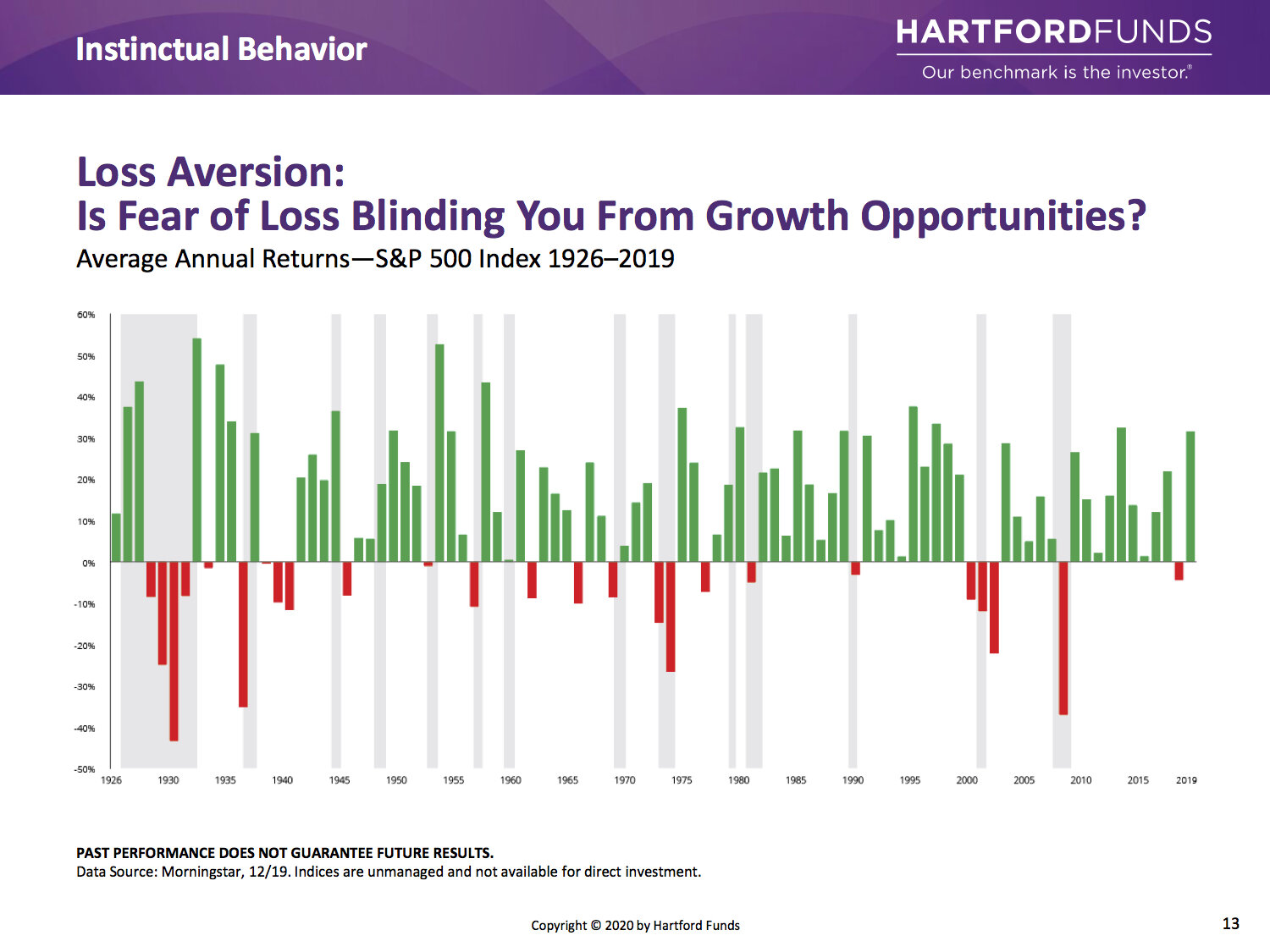

On Thursday, May 21st Bill McManus of Hartford Funds spoke to our clients about ‘Maintaining Perspective in a Crisis’. Please find his presentation below.

Urgent Communication Required by New York State to Insurance Policy/Contract Holders

Dear Clients,

It has come to our attention that recent amendments to insurance and banking regulations have extended grace periods and given you other rights under your life insurance policy or annuity contract if you can demonstrate financial hardship as a result of the novel coronavirus (“COVID-19”) pandemic. These grace periods and rights are currently in effect but are temporary, though they may be extended further.

This applies to all insurance policies, not just policies purchased through us.

We hope that you and your family are doing well and staying safe during this time.

Sincerely,

Lebenthal Financial Services, Inc.

'The Financial Aspects of Covid-19'

Michael has a new article in the latest issue of 50+ Lifestyles. You can view the full issue here.

J.P. Morgan Conference Call Summary

On April 15th we had another conference call and webinar for Lebenthal clients where we got to hear the perspective of J.P. Morgan Vice President and Global Market Strategist Alex Dryden. During his presentation, Alex referenced the following slides that we’d like to share with you.

Make sure you’re on our mailing list so you don’t miss the next conference call. We have another one we will be announcing soon!

BlackRock Conference Call Summary

Dear Friends and Clients,

As a follow up to our conference call with BlackRock Funds, I am happy to attach a copy of the call for you to listen to again if you would like to, or if you did not get a chance to listen on Friday. The comments from our speaker, Blackrock Funds Director and Product Strategist Dan Coppens, are still very relevant. We were pleased to learn that over 140 people decided to join the conference.

A few takeaways from Dan were:

Although the market staged a historic three day rally last week, there is still some selling that needs to take place in the market in order for a firm bottom to be established (Translation: we are not out of the woods quite yet)

The bond market has seemed to calm down, and liquidity and yields are beginning to return to normal.

The biggest concern right now is if the economy will fall into a deep recession before the virus peaks, causing the bounce back to be longer and more difficult. Ideally, the virus will hit its apex before the economy tips over.

The Federal Reserve is buying $75 billion in bonds across the spectrum on a daily basis. This is unprecedented action on their part.

Over the past six weeks investors have parked $286 billion in money market funds waiting to be redeployed into the market.

When the opportunity presents itself, we will arrange a new call down the road. In the meantime, please feel free to contact us with any questions.

Sincerely,

Michael Hartzman, CFP

Lebenthal Financial Services, Inc.

516-349-5555

Dominick Tavella

516-785-1800

A Message from President, Michael Hartzman

Dear All,

I hope this finds you safe and in good health. Today I was invited to participate in a conference call with Blackrock Funds and to hear the insights of the Chief Executive Officer, Larry Fink, and the Chief Investment Officer, Rick Rieder.

These two gentleman are among the brightest and well tuned-in men on Wall Street. I am happy to share their thoughts with you.

According to Larry Fink:

As it relates to the Coronavirus and the effects on the market, he sees this as a twelve to fifteen week process to return to normal. That is how long it will take to get the number of new cases to peak, and then to finally abate.

This is not a financial crisis. Banks across the world are acting together in a coordinated effort to keep liquidity going.

It will take about three trillion dollars from our government to help individuals, small businesses, and corporate bail outs to the industries that need it most.

The opportunities in the market are substantial right now. This is not the time to be selling, but the time to be accumulating cash and jumping in once the virus numbers start to decline in America.

Some companies are positioned to prosper in this period, such as Kroger, Netflix, Amazon, Walmart, and McDonalds, to name a few.

The industries that have been hit the hardest will bounce back (ex. airlines, hospitality, cruise lines, insurance companies)

According to Rick Rieder:

The Fed is not out of tools to help the economy, and they are doing a very good job in providing liquidity to financial institutions.

The Markets will potentially fall some more. However, once we reach stability, we will then see the rebound.

The bond market has seen unprecedented volatility, but this will also begin to stabilize.

As far as it goes at Lebenthal Financial, we all have begun to work from home and to follow the protocols suggested. Rest assured we are fully functional, and have been preparing for this possibility for several weeks. Your portfolios have held up well during this period, and I am happy to review your account in detail at any time.

Stay safe and out of harms way,

Michael